Digital media encompasses content created, stored and distributed digitally and accessible via computers, smartphones, tablets, smart TVs, and other electronic devices.

Its defining feature is its ability to be edited, shared, and accessed on-demand across global networks via the internet or other digital platforms. The digital media industry’s evolution, rooted in film and early broadcast media, continues to evolve and driven by technology, culture, economics, and consumer preferences.

The industry began with the invention of film in the late 19th century, which introduced visual storytelling. Thomas A. Edison’s kinetoscope, developed in 1888 in Menlo Park in my home state of New Jersey, enabled moving images, leading to short, silent films shown in theaters and nickelodeons. From the 1920s to 1960s, radio and television greatly expanded media’s reach. Commercial radio started with stations like Pittsburgh’s KDKA in 1920, while television, viable by the late 1930s, brought news and sitcoms into homes via NBC and CBS networks. The 1970s and 1980s introduced cable and satellite broadcasting, with channels like MTV and CNN pioneering the 24-hour news cycle and on-demand media.

The digital media industry further expanded its consumer reach with devices like compact discs and DVDs, offering superior audio and video quality. During this period, one of my first site selection projects was carried out for Sony which located its magnetic tape plant in Dothan, Alabama, for its wildly popular Sony Walkman portable cassette player, which became a cultural icon during the time. Personal computers, such as the IBM PC and Apple Macintosh, and software like Adobe Photoshop enabled digital editing. The Domain Name System (DNS) in 1983 and commercial domain registration in the 1990s facilitated online media distribution.

The 2000s marked digital media’s maturation, driven by broadband, mobile devices, and social media platforms like Facebook and Twitter. Smartphones, including the iPhone and Android, made media portable, fueling mobile apps and responsive web design. Digital gaming platforms like Steam and Fortnite, alongside virtual and augmented reality (e.g., Oculus Rift), greatly expanded media formats.

Here in 2025, the industry is defined by convergence, blending film, broadcast, and digital technologies. Artificial intelligence, 5G, and immersive formats are reshaping audience engagement. AI tools like DALL·E and Runway enable automated content creation, while algorithms power recommendation systems. Virtual reality, augmented reality, and metaverse platforms like Meta’s Horizon Worlds create new storytelling formats. Short-form (under 1,200 words or 10 minutes) and ephemeral (24-hour) content dominates on platforms like TikTok, Instagram Reels, and Snapchat Stories.

Leaving Hollywood: “Show Me the Money!”

The line “Show me the money!” from the 1996 movie Jerry Maguire is a great metaphor for the financial incentives helping to drive the film and digital media industry’s migration from Hollywood. Hollywood’s boundary with digital media is blurring as film studios like Universal greatly shorten theatrical windows for digital releases, and popular streaming platforms like Netflix produce Oscar-contending films, bridging traditional and digital media.

Exiting their historic base in Hollywood due to high costs, work rules and the devastation and human toll of the recent Los Angeles wildfires, studios are creating new hubs of production around the country in states like Texas, Georgia, Louisiana, North Carolina, New Jersey and others. The latest major landing spot is Las Vegas, being dubbed “Hollywood 2.0.” The largest Vegas project is the $1.8 billion, 31-acre Summerlin Studios, a joint venture between long-time Boyd Company client The Howard Hughes Corporation, Sony Pictures Entertainment, and Warner Bros. Discovery, with actor Mark Wahlberg as a consultant.

FilmLA, the group leading the charge to stop the hemorrhaging of Hollywood jobs and lobbying Sacramento for more generous incentives, reports a 40 percent decline in Los Angeles production over the past decade. California’s Film and Television Tax Credit Program, capped at $330 million, is proposed to expand to $750 million starting in the 2025-26 fiscal year to help retain jobs. California’s proposed expansion, via Governor Newsom and bills AB 1138 and SB 630, would make its program one of the most generous, second only to Georgia’s uncapped incentives.

President Trump has also included the film industry in his agenda to reshore jobs back to the U.S. Trump has met with Hollywood actor Jon Voight at Mar-a-Lago to discuss plans for supporting the American film industry, if not through tariffs, then by co-production treaties, tax breaks and regulations. Voight joins Sylvester Stallone and Mel Gibson as special ambassadors to Hollywood, addressing the issue of runaway film and TV production to countries offering major tax incentives, cheaper labor, or unique geographies.

Digital Media Incentives

With the line between the traditional Hollywood film industry and digital media continuing to narrow by technology and shifts in consumer demand, states are reacting to this trend by expanding incentives to include digital media like video games, mobile gaming apps, animation and other interactive entertainment software products.

Some key state programs with digital media components include:

- New Jersey: Film & Digital Media Tax Credit Program

- Louisiana: Digital Interactive Media and Software Tax Credit

- New York: Digital Gaming Media Production Credit

- Texas: Moving Image Industry Incentive Program

- Georgia: Film, Music, and Digital Entertainment Tax Credit

- California: Film and Television Tax Credit Program

- New Mexico: Film Production Tax Credit

High-Growth Digital Media Sector: Podcasts

The high-profile U.S. podcast market, valued at $10.2 billion, is driven by growing advertising, listenership, and smartphone penetration. YouTube, Spotify, and Apple platforms dominate, with Spotify holding a 35 percent market share alone. Leading podcast genres include comedy, news, true crime and sports.

A study by Common Sense Media and Survey Monkey found that 54 percent of teenagers report finding news at least a few times a week on social media platforms. Another report from the Pew Research Center indicated that nearly 40 percent of young Americans get their news from social media influencers. The single leading podcast, “The Joe Rogen Experience,” combines humor with interviews, driving high engagement.

Some of today’s leading U.S. podcasts include:

- “The Joe Rogan Experience” hosted by Joe Rogan covering diverse topics with guests from entertainment, politics, and science.

- “Crime Junkie” a true crime podcast hosted by Ashley Flowers and Brit Prawat with detailed storytelling of high-profile criminal cases.

- “This American Life” hosted by Ira Glass is a popular storytelling podcast since 1995 earning awards like the Pulitzer Prize.

- “The Daily” produced by The New York Times and hosted by Michael Barbaro and Sabrina Tavernise provides in-depth news analysis in 20-minute episodes.

- “Call Her Daddy” hosted by Alexandra Cooper is a top-ranked podcast with a large, predominantly young female audience combining relationship advice and celebrity interviews.

In the commercial real estate development field, these are some of today’s top podcasts:

- “Commercial Real Estate Show” hosted by Michael Bull, the veteran commercial real estate broker and founder of Bull Realty. His popular show features weekly interviews with economists, analysts and industry leaders providing market intelligence and forecasts. The Boyd Company has had the pleasure of guesting on Michael’s Atlanta-based show a number of times.

- “BiggerPockets Real Estate Podcast” hosted by David Greene, Rob Abasolo and others. Covering both residential and commercial real estate, this podcast is known for its deep dives into multifamily, commercial office and investment strategies.

- “The Crexi Podcast” hosted by Taylor Curtiss and Shanti Ryle. Launched in 2021 by Crexi, a CRE digital marketplace, this podcast delivers biweekly, long-form conversations with leading investors, developers and brokers. It covers market trends, deal strategies and industry updates.

- “Commercial Investment Real Estate Podcast” produced by the Chicago-based CCIM Institute with varying hosts. Serves as a companion to the Certified Commercial Investment Member Institute’s quarterly magazine with topics like REITs, landlord-tenant relationships and investment strategies.

“EconDevMedia.com” is a domain owned by The Boyd Company which is in discussions with New York and Los Angeles media interests for launching digital and podcast content on corporate mobility and the intersection of that dynamic field with politics, sports, travel, pop culture and the economy at-large. Its 2026 launch will usher in the next half-century of business for our firm founded on Princeton, NJ’s historic Nassau Street back in 1975.

High-Growth Digital Media Sector: Esports

The esports industry is a dynamic sector of the digital media industry with a market size projected to exceed $5 billion by the end of the decade. Entertainment software companies like Tencent, Electronic Arts, Riot Games, Activision Blizzard, Epic Games, Valve, Krafton, and Hi-Rez Studios are leading corporate players, producing the most prominent esports titles. With over 50 million users, new revenues are streaming in from sponsorships, advertising, media rights, merchandise, ticketing, and betting. Some 220 U.S. colleges now have varsity esports programs up from 75 in 2018.

Like its investments in professional golf through the creation of LIV Golf, a rival tour to the PGA Tour, Saudi Arabia is also heavily investing in the esports industry as part of its Vision 2030 plan, which aims to diversify the country’s economy and create new entertainment opportunities. Savvy Gaming Group, owned by the Public Investment Fund (PIF), has invested over $38 billion in the esports sector and is building a gaming city called Qiddiya, featuring a dedicated esports district, to attract visitors and establish the country as a global esports destination.

During a recent entertainment software location project, we learned that Stockton University in Atlantic County, NJ, has partnered with the New Jersey Economic Development Authority to establish the Esports Innovation Center (EIC) on Atlantic City’s famous Boardwalk. The EIC is working to position Atlantic City as an East Coast esports hub. Stockton’s Bachelor of Science in Esports Management is one of the nation’s first public undergraduate esports degree programs focusing on esports business and event management. Also in Atlantic City, New York-based Vivo Investment Partners has proposed a 30,000 sq. ft. esports center, which would be built in the city’s Claridge Hotel’s theater space.

On the technology front, esports requires ultra-low-latency, high-bandwidth internet. Global internet provider Continent 8 Technologies’ Tier 3 data center provides connectivity and cybersecurity for both Atlantic City’s casino industry, esports events and digital media companies like ACX1 Studios.

ACX1 is a half million sq. ft. studio complex on the former Playground Pier serving as a film and media production hub with over 150 sets, a music incubator, and creative spaces for artists. It is an example of a digital media company leveraging Atlantic City’s advantage in film tax credits. The New Jersey Film and Digital Media Tax Credit Program offers a base tax credit of 30 percent on qualified production expenses statewide. However, in Atlantic City, the credit increases to 35 percent for qualified expenses. ACX1 joins California-based studios like Netflix and Lionsgate making major investments in the state that started the media revolution over a century ago through the work of “The Wizard of Menlo Park,” Thomas A. Edison.

Digital Media Site Selection

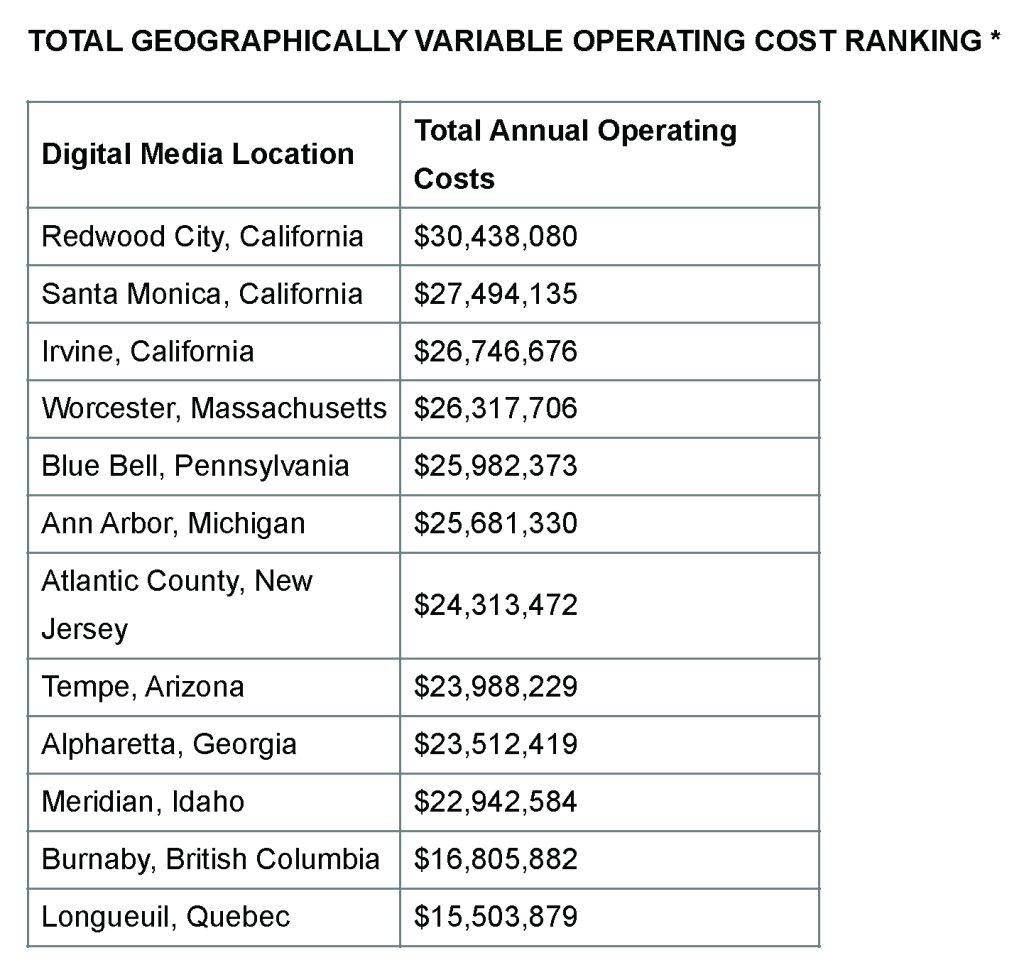

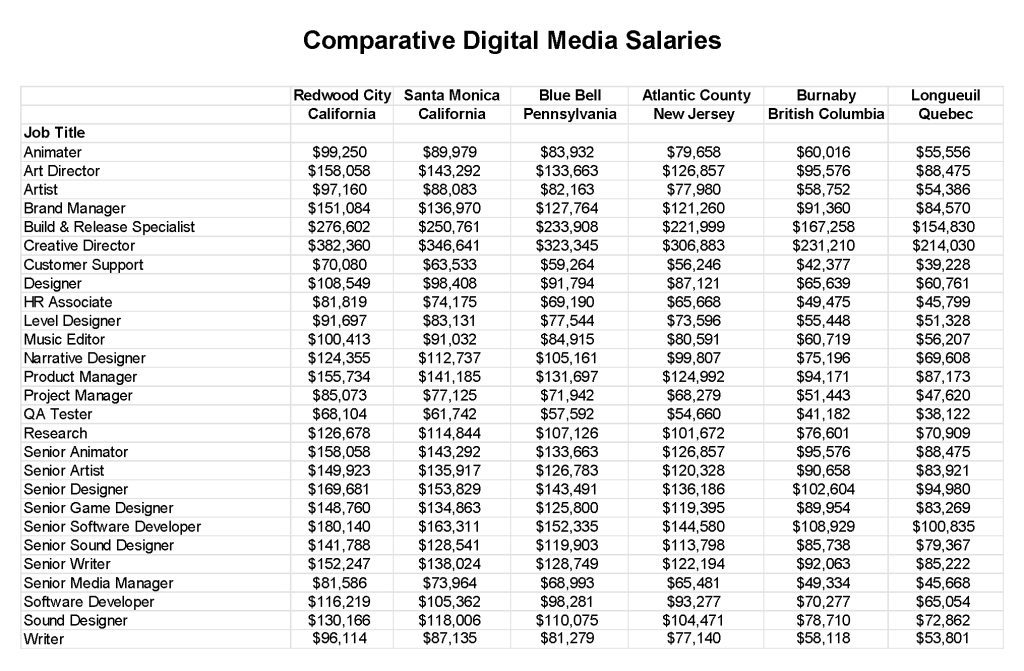

The Boyd esports and entertainment software project that surveyed Atlantic City also identified several other promising, smaller market locations outside of major digital media hubs like New York, San Francisco and Chicago. The analysis considered existing software and digital media operations, university support, and real estate factors. Comparative annual operating costs, salaries and academic support for several surveyed locations are shown below.

*Based on a newly constructed 50,000 sq. ft. digital media center employing 150 workers. The analysis includes costs for labor, real estate, construction, power, taxes, and other factors. All costs are in U.S. dollars.

*Based on a newly constructed 50,000 sq. ft. digital media center employing 150 workers. The analysis includes costs for labor, real estate, construction, power, taxes, and other factors. All costs are in U.S. dollars.

In summary, I have seen a number of transformative advancements in the digital media space over the years. Sony, e.g., has gone from relying on magnetic tape manufactured in Dothan, Alabama, to drive its iconic Walkman portable cassette player to today employing the latest generative AI tools like Stable Diffusion, ChatGPT and Midjourney to help create the latest blockbuster video games at its AAA PlayStation Studios in California and Washington State.

Looking ahead, the industry will continue to build on its film and broadcast legacy while adopting new technologies like generative AI, extended realities, and blockchain. Challenges, no doubt, will be many and include regulatory speed bumps, privacy issues, ethical AI use, and the need to adapt to ever-changing shifts in cultural preferences and consumer demand.

About John H. Boyd

John H. Boyd is founder and principal of The Boyd Co. Inc. Founded in Princeton, NJ, and now based in Boca Raton, FL, the firm provides independent site selection counsel to leading U.S. and overseas corporations. Boyd Co. multimedia clients include Liberty Media, Rogers Communications, USA Network, Dotdash Meredith, Dell, Time, Inc., and Hachette Livre.

Other organizations served by John Boyd over the years include many Fortune 500 companies, The World Bank, The Council of Supply Chain Management Professionals (CSCMP), The Aerospace Industries Association (AIA), MIT’s Work of the Future Project, Canada’s Privy Council and The President’s National Economic Council.