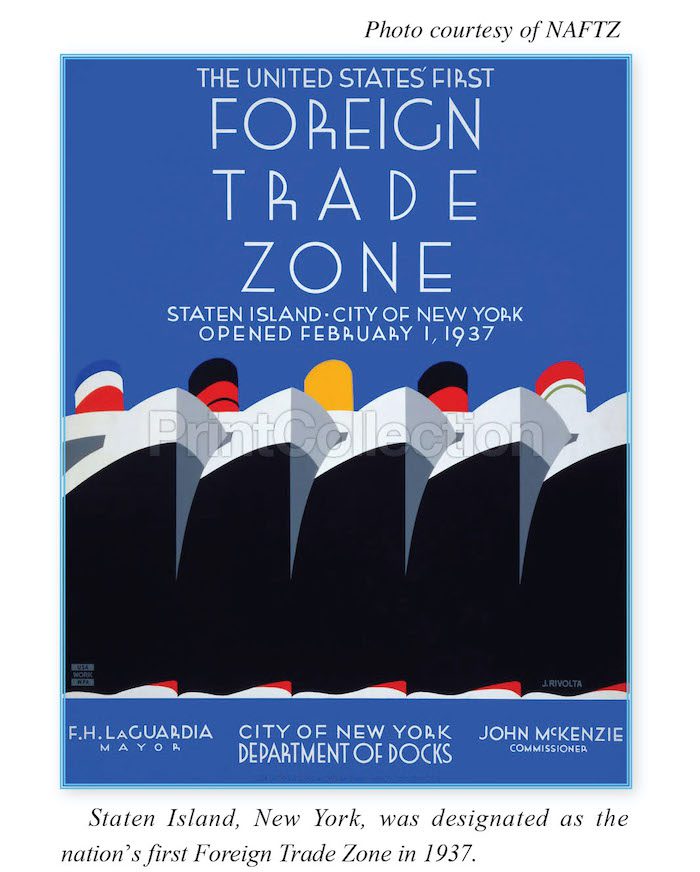

Since 1937, when the first Foreign Trade Zone (FTZ) in the U.S. opened its gates at the Port of New York, some 200 active designated duty-free enclaves have been established across the country.

According to the latest figures, there are 374 active production operations handling approximately $950 billion in import shipments in the nationʼs FTZs in 2023 with more than 550,000 people employed within 1,300 active FTZ operations during the year.

The benefits of utilizing an FTZ are significant.

In an FTZ, both foreign and domestic merchandise is treated as international commerce that can be assembled, exhibited, cleaned, mixed with other components, processed, relabeled, repackaged, salvaged, repaired, sampled, tested, stored, displayed, and re-exported without U.S. Customs and Border Protection (CPB) intervention.

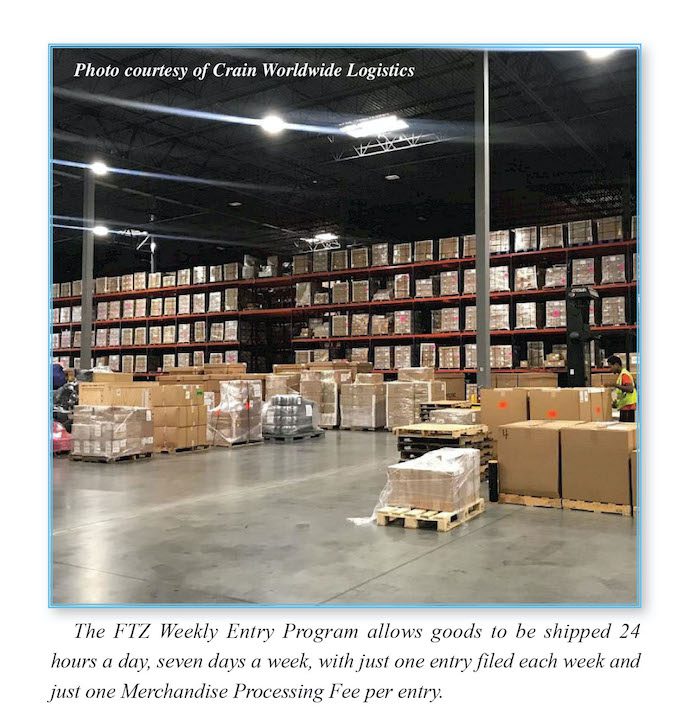

Customs duties on goods processed or assembled in the FTZ are reduced when imported components have a higher duty rate than the finished goods, while processing/entry fees can be reduced by as much as 85 percent with the Weekly Entry Process (WEP).

The WEP allows goods to be shipped 24 hours a day, seven days a week, with just one entry filed each week and just one Merchandise Processing Fee per entry.

Harbor Maintenance Tax payments can be deferred and paid quarterly instead of at time of entry, and customs duties are eliminated entirely when goods are re-exported from the FTZ with imported goods exempted from state and local ad valorem taxes when they are held in the FTZ.

“Many industries can benefit from an FTZ including pharmaceuticals, semiconductors, aerospace, automotive, and electronics,” says Denise Yanez, manager of the Phoenix Economic Development Program and Administrator of FTZ. No. 75.

“Companies tied to advanced manufacturing, semiconductor supply chains, nutraceuticals, electronics, aerospace, consumer products, and electric vehicles are among those successfully operating in FTZ 75,” she says with the proviso that while operating in a Foreign Trade Zone offers numerous advantages, “it may not be beneficial for every importer; a cost/benefit analysis should be conducted to determine suitability.”

“Companies tied to advanced manufacturing, semiconductor supply chains, nutraceuticals, electronics, aerospace, consumer products, and electric vehicles are among those successfully operating in FTZ 75,” she says with the proviso that while operating in a Foreign Trade Zone offers numerous advantages, “it may not be beneficial for every importer; a cost/benefit analysis should be conducted to determine suitability.”

One of the challenges facing companies utilizing the FTZ program “are the limited resources available at U.S. Customs and Border Protection (CBP), which provides regulatory oversight of FTZ operators.”

“Additionally, when tariffs fluctuate frequently, there is a greater chance of inadvertent impacts to U.S. companies,” says Yanez. “In the case of U.S. FTZs, new restrictions included in tariff announcements are removing some of the flexibility that is built into the FTZ program, one example of an inadvertent impact is that U.S. FTZs might face trade remedy tariffs for longer periods compared to other U.S. importers.”

Another issue is the limitation on the inverted tariff benefits which, she says, “is making it more difficult for U.S FTZs to remain cost-competitive in this challenging tariff environment.”

Inverted tariffs occur when the duty rate on a finished product is lower than the duty rate on its individual components and are a common residue of ongoing trade negotiations or severe fluctuations in trade flows.

Foreign Trade Zones operate under the oversight of the federal Foreign Trade Zones Board, which allows for any merchandise that is not expressly prohibited from U.S. entry to be admitted into an FTZ.

The FTZ Board must specifically authorize production activity, which is defined as the substantial transformation of a foreign article or an activity that changes the condition of an article to such an extent that its customs classification or eligibility for entry into the U.S. for consumption is also changed. Retail trade is not permitted in Foreign-Trade Zones.

“U.S. FTZ Board staff cases are surging,” says Melissa Irmen, Director of Advocacy & Strategic Relations at the National Association of Foreign-Trade Zones.

“Weʼve already seen 186 cases in 2025, projecting nearly 372 for the year—a 62 percent increase over last year. This indicates more companies applying for sites, but production or manufacturing applications are tracking similarly to previous years with around 91 FTZ-related notices so far this year.”

The result, she says, is that “companies are looking to the program to help defer the duty payments to improve cashflow, but with current restrictions in the executive orders directed toward U.S. FTZs, the manufacturing benefits are limited.”

The NAFTZʼs Irmen advises that, “For each company, a Return on Investment should be investigated before applying for U.S. FTZ designation. The cost of the added compliance of the program must be weighed against the benefits of duty deferral and exporting from the facility.”

Unfortunately, she adds, “many of the manufacturing benefits in the U.S. FTZ program have been curtailed by restrictions included in the tariff orders.”

Countless big-ticket companies have taken advantage of the FTZ program including clothing manufacturer Tommy Bahama, which repurchased its product licensing from Canada and combined its distribution facilities into a single subzone location that serves as part of the Port of Seattleʼs FTZ No. 5.

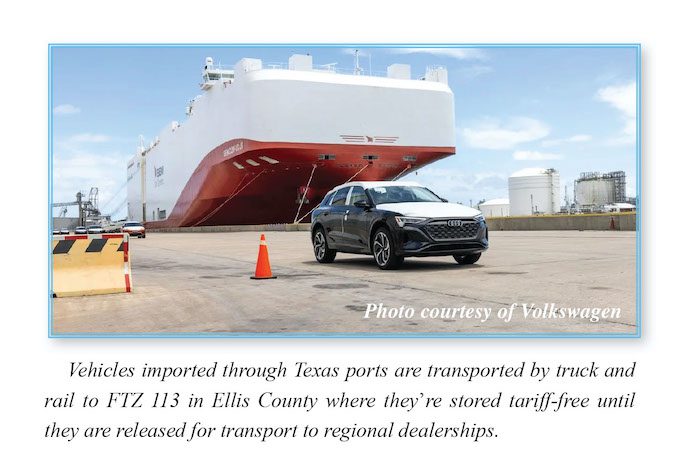

Texas currently is home to 32 Foreign Trade Zones. At one, for example ‒ FTZ 113 in Ellis County ‒ cars imported from Germany, Japan, and Korea are held tariff free until they are released for transport to regional dealerships, a move that cuts the dealer’s inventory costs.

The City of Palmdale, California, operates FTZ No. 191, which encompasses several foreign trade sites on 1,300 acres centered around Palmdale Regional Airport. The Zone is home to the operations of several major companies, one of which produces computers with imported electronics that are exported to foreign markets, eliminating the duties the manufacturer might otherwise have to pay.

Another is the Louisville Riverport Authority where Miguel A. Zamora serves as Executive Vice President with responsibility for oversight of FTZ 29, one of the nation’s busiest inland Foreign Trade Zones.

Located on the busy Ohio River, the Zone, he says, currently “has 31 distinct subzones or general-purpose sites in Kentucky operated by 23 unique companies” including manufacturing zone operations for Toyota, Heir, Lexmark, Hyster-Yale, North American Stainless, LL Flex, Dow, Columbia Sportswear; and warehouse and distribution operators including UPS and two Kentucky riverports.

“FTZ 29 turns 50 in 2027, and our stretch internal goal is to reach 50 active sites / subzones by then,” says Zamora. The Zone currently generates nearly $5 billion in exports, or roughly 10 percent of Kentucky’s total exports.

Currently, he adds, “We only have zone operations in 8 of 25 counties in our designated Alternate Site Framework (ASF) service area and are working with local county [economic development] organizations and government to improve that metric.”

Work is also underway to expand the Zone’s ASF service area to include adjacent counties that have seen organic industrial development that were not included in the original ASF designation and are adjacent to a Customs & Border Protection port of entry, according to Zamora.

In a major FTZ-related development, ground was broken in June at the new Port Wentworth Commerce Center, a 10-million-square-foot, master-planned logistics campus roughly seven miles from the Port of Savannah.

Situated within the 17-county FTZ No. 104, the Center will be the largest near-port logistics development in the southeastern U.S. and “serve as the premier port-centric logistics park on the Eastern Seaboard” when completed, according to project developer, Dermody Properties.

In October, Salt Lake City applied to transfer the status of its grantee authority over FTZ No. 30 to the World Trade Center Utah, a private nonprofit that provides global markets tools to Utah enterprises.

The transfer was granted and is expected to eventually expand to cover the scope of the Zone to every one of the state’s 29 counties.

The San Francisco Bay Area is known as an active hub for import-export business, particularly manufacturers who have parts and components produced overseas and shipped into the U.S. for eventual assembly into a U.S-made product, according to Rosemary Coates, executive director of The Reshoring Institute in Silicon Valley, California.

Speaking at the East Bay Manufacturing Summit, sponsored late last year by the East Bay Economic Alliance, Coates called the region’s FTZ “a strategic resource that helps businesses ensure import and export products flow without delay while effectively managing trade and tariff regulations.”

The Bay Area FTZ ‒ No. 3 ‒ encompasses San Francisco, San Mateo, Contra Costa, Marin, and Solano Counties, as well as portions of Sonoma and Napa Counties.

“Logistics providers that operate FTZs provide expertise and resources to help importers minimize fees and tariffs on foreign-sourced items, as well as exports,” said Coates.

“Companies with overseas sourcing partners ‒ as well as those who export ‒ should look early into FTZ as part of their supply chain strategy. By utilizing an experienced FTZ logistics operator you can ensure that you benefit from all the available advantages of an FTZ to make your business as competitive as possible.”