Introduction

The human resource equation influencing geographic deployment of corporate operations has long played a prominent role in resolving challenges such as: (a) expansion at existing sites; (b) consolidation of existing sites; and (c) where to site relocated or new operations. As we enter the second half of this decade, the HR component of location decision making has ascended to the top of the food chain among factors shaping the geographic footprint of most industries.

In this article we will look at the intensifying labor shortage, pro-active measures to cope with the labor supply challenge, and adopting a systematic process for selecting locations whose labor market resources are well aligned with both near term and longer-range human resource requirements.

The Labor Shortfall

Labor market strains have become exacerbated since the end of the COVID pandemic. Roughly 2/3 of companies are reporting difficulty in fulfilling staffing requirements. Until recently the most protracted shortage embraced skilled workers. The supply deficiency has now expanded to include entry level talent possessing solid foundational skills that can learn a company’s technology and daily work requirements.

There are multiple reasons why the U.S. is experiencing a labor shortage. Among the causal factors are:

1. Unfavorable Demographics

- Between 2012 and 2030 an estimated 75 million baby boomers will have retired

- New labor market entrants, those between the ages of 16-24 constituted 13.8% of the population in 2024, down from 15.6% in 2014

- However, the proportion of the U.S. population age 65+ rose from 18.1% (2014) to 23.0% (2024)

- Moving forward there will be a modest yet steady decline in the 16-24 age cohort while the older population segment will continue to increase

2. The labor force participation rate has fallen from 66.1% in 2005 to 62.4% in the second quarter of 2025. Best estimates suggest that there will not be a notable rise in the participation rate over the foreseeable future. In fact, a slight drop to 61.2% is forecast for 2030.

3. Net migration to the U.S. has precipitously declined in recent years. This has diminished an important labor source for U.S. companies.

4. The unemployment rate continues to be historically low, hovering in the 3.7% to 4.2% range (as compared with around 6% ten years ago)

5. At best there has only been only a moderate pace of investment in automation to maximize efficiency and curtail the level of labor intensive functions

- In a survey by Integris 26% of manufacturing workers reported that their company’s technology was outdated or somewhat outdated. Another 26% stated that technology was only somewhat advanced.

- In the same survey 57% of manufacturing managers cited cost as a deterrent for fully capitalizing on available technologies

6. The Integris survey also revealed that 75% of workers reported their companies have not sufficiently invested in upskill training. This is despite the fact that over half of the workers said they lacked the technical skillset necessary for career advancement. The rationale to not adequately invest in upskill training boils down to cost and downtime.

7. Additional contributory factors include:

- Insufficient work hours flexibility

- In many situations limited career advancement opportunities

- Lack of access to and cost of childcare

- Worker’s desire for higher pay and better benefits

Potential Solutions

From a company perspective, there are usually not one or two major steps that can be taken to ensure successful staffing experience (recruitment and retention). The following measures should be examined to see which, in combination, should be adopted to strengthen a company’s ability to effectively compete for talent:

- Benchmark of HR practices on a local basis and learn from national examples

- Take advantage of workforce data and best practice examples from industry associations (Manufacturing Institute) and HR nonprofit entities (e.g., Society for Human Resource Management)

- Adjust compensation and benefits to maintain a competitive edge from an HR perspective

- Allow for more work life balance including paid time off policy, flexible hours and in an office environment perhaps a hybrid workplace model. In manufacturing, seriously explore the possibility of flexible work hours

- Develop a formal career advancement pathway

- Institute employee reward/recognition programs

- Optimize the onboarding process including pre-boarding, workplace preparation/readiness, comprehensive orientation, clear communication, mentor/buddy system, team building, learning management system (LMS), customized portals, automated reminders, collect feedback, iterate, and improve, and above all else integrate company culture onto the onboarding process

- Rely on the most effective recruiting sources/methods such as:

• Employee Referral (including bonus) program

• Online job boards and digital platform targeting specific demographics, occupations, and industries

• Leverage social media platforms

• Digitize and simplify the application process

• Participate in job fairs and recruiting events

• Partner with local organizations (e.g., technical college, CTE high school, economic development, workforce investment program)

• Draw from the underserved and second chance pool

• Allow for walk-in applicants

• Ensure a fair, expeditious, and transparent experience for job candidates - Create a supervisor development/training program that encompasses both technical and soft skills

- Where practical for manufacturing and warehousing, operate in a temperature-controlled environment

- Actively participate in community events and corporate giving to boost the company’s reputation

When developing an automation strategy, obtain employee input. Once the strategy is created, adjust training programs as appropriate. This often will embrace underwriting the cost of continuing education including obtaining certifications.

In addition, one component of a strategy to tamp turnover is to periodically survey employees. The engagement process should entail communicating results and steps to improve the workplace environment. Lastly, employees want to feel proud of their workplace. Strive to have an attractive appearance, both external and internal.

Economic development organizations have become increasingly more involved in workforce development. Ideally, economic and workforce development should be housed in one organization. At the very least, the economic development entity should assume responsibility for coordinating disparate workforce partners and aligning existing or new industry with the most appropriate entity to provide requisite assistance. Among success keys for workforce development:

- Identify and encourage collaboration among stakeholders including:

• Companies (often via local formal or informal associations)

• Workforce Investment Board

• Economic Development Group

• Higher Education

+ Four-Year Colleges/Universities

+ Two-Year Colleges

• High Schools including those with a dedicated CTE program

• Nonprofit groups (e.g., foundations) - Create a blueprint depicting all stakeholders and roles and share with local industry

- Ensure that workforce and training programs cover both the local jurisdiction and a well-defined region (e.g., county and metro)

- Workforce Development must be metric driven. Delineate current and emerging jobs that will be in greatest demand (utilize both secondary research sources and employer surveys).

- To the maximum possible extent, create workforce development/training programs geared toward specific industry sectors such as manufacturing (could have sub-sectors), logistics, construction, healthcare, etc.

- Define HR requirements of target industries and quantify talent pool depth plus training resources

- Provide wrap-around services for underserved and second chance workers

- To gain buy-in from employers, it is important to quantify the Return on Investment (ROI). Elements should include program costs, employee productivity/retention rates, and speed to promotion/career advancement

- Define and promote success stories

- Encourage internships, apprenticeships, and pre-apprenticeships

- Hold periodic HR workshops including sessions devoted to best practices

- Actively publicize the value of technical careers, especially in manufacturing

- Participate in nationally recognized credentialing/certification programs such as ACT/Work Ready

- Engage in a concerted effort to guide local employers to introduce automation

- As most states do offer pre-employment training for new employees (both existing and incoming companies), take advantage of these programs

- Dedicate training resources for re-skilling/upskilling as well

- Reflecting a demand driven imperative, consider adopting the Talent Management Pipeline (TPM) designed by the U.S. Chamber of Commerce Foundation. This initiative is an employer led approach that organizes the business community into employer collaboratives to address the most critical workforce needs, using talent supply chain strategies and practices.

- As many states and communities are implementing, design and activate a talent attraction strategy

Among corporations that have highly regarded, innovative workforce development and training initiatives are Abbott, Accenture, Allianz, Anheuser Busch, Apple, Applied Materials, AT&T, BillGO, Formlabs, General Electric, Honeywell, IBM, Johnson & Johnson, Lakeside Software, Microsoft, Mutual of Omaha, Randstad, USAA, and Wells Fargo.

There are many economic development organizations that have fully embraced workforce development strategies as part of their core mission. All of the samples below coordinate workforce development and have overseen implementation of workforce endeavors such as those noted above:

- Empire State Development’s Office of Strategic Workforce Development

- Georgia Department of Community & Economic Development (Connection with GA Quick Start)

- Michigan Economic Development Corporate Talent Attraction Team

- Mississippi Development Authority’s Business Research & Workforce Development

- Missouri One Start, a division of Missouri Department of Economic Development

- Nevada Governor’s Office of Economic Development, Workforce Development unit

- Virginia Economic Development Partnership Talent Accelerator

Among regional economic development groups with extensive workforce programs are:

- Bucks County (PA) Workforce & Economic Development

- Charleston County, SC

- Lehigh Valley Economic Development

- Louisville Economic Development Alliance

- Lubbock (TX) Economic Development Alliance

- Metro Atlanta Chamber

- Nashville Chamber

- Northern Nevada Development Authority

- Richmond Economic Development Partnership

- Savannah Economic Development Authority’s Regional Industry Support Enterprise (RISE)

- South Central Kentucky (Bowling Green region)

- Tulsa Chamber

Labor Market Component of Site Selection

The challenge of finding the best long-range location for corporate operations (e.g., manufacturing, distribution, HQ, back/middle offices, innovation/R&D Centers) has become and will continue to be more vexing. A structured, multi-phase, and data driven approach is essential.

Once a project team has been assembled, the first step in the process is to define location parameters including quantification of headcount requirements. In this project planning phase, the following needs to be addressed:

- Project objectives

- Geographic restrictions such as proximity to customers, proximity to raw materials, proximity to seaports, distance from a commercial airport with nonstop service to selected cities, absence of competitor locations, etc.

- Importance of being in a location with a robust industry ecosystem (often important for high-tech operations)

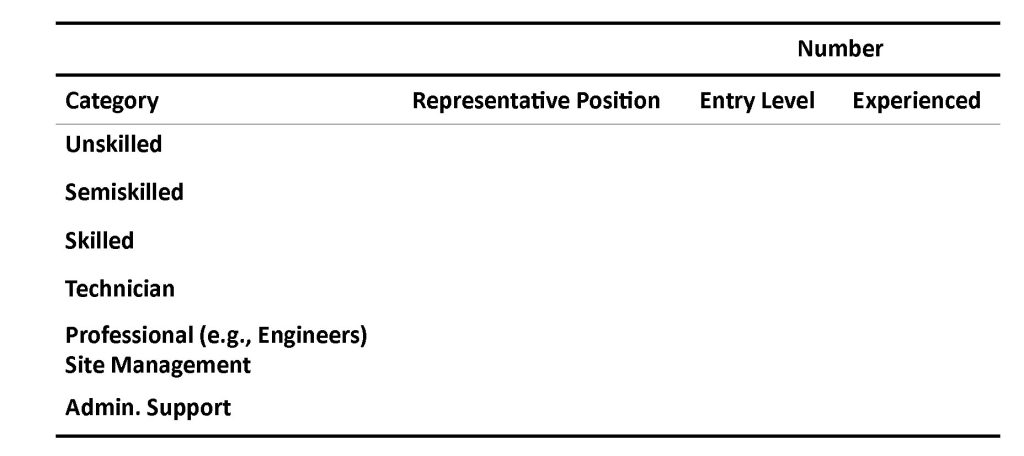

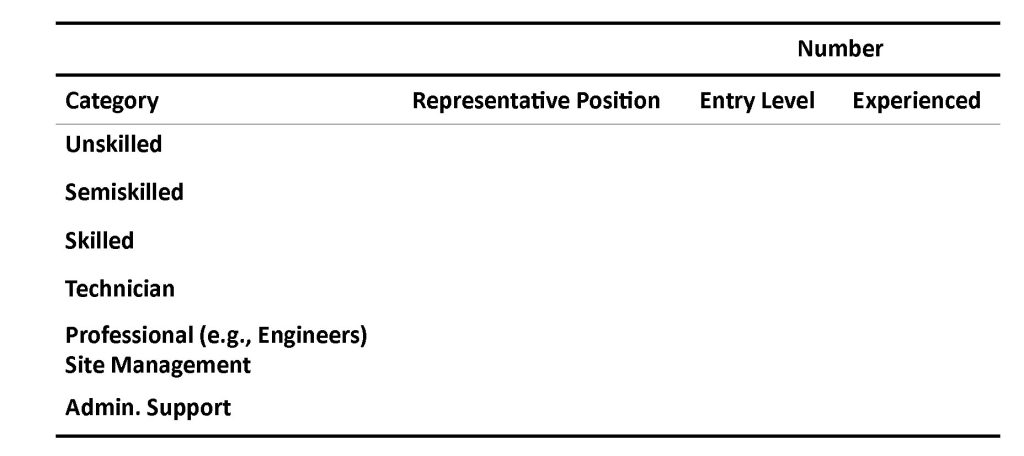

- Quantify year one and future (including ramp-up period) for both entry level and experienced by position, e.g.,

- Based on experience, the most difficult position to fill

- Budgeted wage levels by position

- Hours of operations and shift work

- Importance of access to technical colleges (or high schools) for training and recruiting

- Importance of access to four-year colleges/universities for talent pool and potential partnerships

- Labor/management relations concerns

Once planning is completed, we now enter the location analytical and selection phases. First up is undertaking research within a geographic search region to identify a shortlist of location candidates. The first task includes desktop research to winnow the field. Metrics (e.g., population size) are established for a multi-round “screening” process. Areas passing the statistical threshold are carried forward to the next round. Illustrative screening factors include the following:

- Population (e.g., size, age, growth)

- Industry presence

• Employment (size)

• % of total employment - Depth of relevant occupations

• Size in relation to need (e.g., if a project requires 25 experienced machine operators, then a qualifying area might need a talent pool of 250 or a 10:1 ratio)

• Labor market quotient (a measure of potential over-concentration and possible intense demand for the skillset) - Underemployed pool (e.g., in pertinent lower wage industries or occupations)

- Workforce educational attainment (e.g., 12-15 years)

- Indirect labor cost indicators, e.g.,

• Median household income

• Cost of living index

• Housing cost - Median wage by selected occupation

Typically, desktop research utilizing both government and private data sources will result in a longlist of promising locations (often 6-10). At this stage, a confidential “Request for Information” or RFI is issued to each area’s lead economic development group. The RFI is designed to elicit intel not available from desktop research.

Such intel covers the following:

- Roster of major employers (with headcount)

• Overall

• Industry specific - New/expanding companies

• Overall

• Industry specific - Downsizing companies

• Overall

• Industry specific - Annual graduates

• High School (including an estimate of those entering the labor market)

• Two-Year College

+ All graduates

+ Industry/occupation specific

• Four-Year College

+ All graduates

+ Curriculum specific - Local wage and benefits survey

- Unionized companies

Results from desktop research and RFI responses are combined to rank/score each longlisted location. The scorecard should be divided into HR operational factors and cost. Each factor needs to be assigned an appropriate weight (e.g., 1-10). Weighted scores are then tabulated. This will lead to a selection of finalists (i.e., shortlisted locations), often three.

The project team will next engage in empirical research. This will be composed of both virtual and in-person field investigation. Each area’s lead economic development entity will arrange fieldwork activities. Empirical research will embody the following:

- Confidential interviews with several employers to gain insights on specific human resource dynamics including competitive demand, supply/applicant flow, compensation, key benefits, HR practices, recruiting methods, best submarkets from a labor draw perspective, importance of onsite/nearby amenities, importance of a temperature controlled building if manufacturing or distribution, staffing off shifts/weekends, state labor regulations, and essentials to achieve/maintain preferred employer status.

- Confidential interviews with other organizations such as:

• Staffing agency

• Workforce Investment Board

• Education/training institutions

• Industry associations - Tours of available sites/buildings within the preferred sub labor market(s)

- Quality-of-life tours

- Discussion with the lead economic development organization on considerations such as types of companies/operations looking at the area, target industries, availability of mega sites that could attract a mega employer with large headcount levels, and potential incentives (e.g., monetizable job creation tax credits)

The project team must now digest results, including opinions on the long-range attractiveness of each shortlisted location from an HR perspective. It is important that the best submarket from a labor draw viewpoint does have qualified sites/buildings. This is especially important given increasing reticence of workers to the commute appreciable distances (e.g., beyond 30 minutes). Also, if an office operation determine how well your preferred workplace model (either hybrid or full-time office and individual vs. shared desk assignments) will play well in the targeted location.

Each finalist location will be ranked/scored. The best location (including submarket) and alternate will be chosen. The project would then enter the commitment phase, embracing negotiations for real estate and incentives. During this phase, a comprehensive HR plan will also need to be crafted.

Conclusion

The human resource dimension of the business location equation looms ever larger, whether for siting new facilities or determining whether to expand existing operations. Regarding the latter, limitations to on-site expansion have been historically physical related (e.g., site size, building condition, utility infrastructure). Today and well into the future, labor market considerations could also comprise a limiting dynamic for on-site expansion. This requires extensive due diligence to ascertain if current sites can successfully operate from an HR perspective.

Regarding the location of new (or relocated) capacity, HR requirements must be well documented. Then a metric driven research approach is necessary to ultimately arrive at a location decision that is favorable on critical labor market factors such as current/emerging demand, talent pool depth, market competitive wage, wage escalation, workforce stability, and what it takes to earn employer of choice status. And again, choosing the right sub labor market in any area will be instrumental for successful staffing.

Pertaining to the labor shortage it is here and will intensify. Companies must carefully examine internal policies and consider adopting additional measures ranging from upskilling to better onboarding to help overcome the labor challenge. Of critical importance will be the introduction of new technology/automation. Employee involvement and work culture also need to be considered. Also, companies need to take advantage of resources offered by economic development groups and other stakeholders.

Lastly, it has become apparent that economic and workforce development are inextricably tied. The two services should be housed under one roof or at least closely coordinated. Employers should have a single contact point to avail themselves of workforce development/training services. It will also be key for workforce development to be driven by: (a) sectors; (b) occupational demand; (c) and performance metrics.

About the Author

Dennis J. Donovan is a Principal of Wadley Donovan Gutshaw Consulting, LLC based in Bridgewater, NJ. WDGC has been advising corporations on location strategy and site selection for four decades. The firm has developed a core expertise in integrating HR Dynamics with Location Decisions for new and expanded business operations.